AMENDED DISTRIBUTOR AGREEMENT DATED SEPTEMBER 3, 2025

Published on November 14, 2025

EXHIBIT 10.1

DISTRIBUTOR AGREEMENT This Distributor Agreement (the "Agreement") was made and entered into as of this 19 day of June, 2025 (the "Effective Date"), by and between and now amended by the parties on September 3rd 2025 , listed in the “Amendment 1”, “Amendment 2”, and “Amendment 3” located in the Amendment sections below. 1. QS Energy, Inc. ("Manufacturer"), a corporation organized under the laws of the State of Nevada, listed on the OTC Markets under ticker symbol [QSEP], with its principal executive offices located at 23902 FM 2978, Tomball, TX 77375 . 2. VIPS Petroleum ("Distributor"), a corporation organized under the laws of England and Wales, with principal offices located at Ofsec, Salt Lane, Salisbury, Wiltshire, England, SP1 1DU . For each country that is onboarded, VIPS Petroleum will be setting up a separate distribution company for each order. 1. APPOINTMENT AND SCOPE 1. Exclusive Distributor : Manufacturer hereby appoints Distributor as its exclusive distributor for the promotion, sale, and lease of QS Energy’s Applied Oil Technology (AOT) Units within its assigned territories, subject to the terms and conditions herein . 2. Products Covered : This Agreement applies to all AOT Units and related services , including but not limited to installation, maintenance, and performance testing services . 3. Territorial Exclusivity : VIPS shall have exclusive distribution rights for AOT units in Indonesia, Ghana, Nigeria , Malaysia, Singapore, Vietnam, Laos, Philippines, Australia, Bahrain, and Thailand for a period of twelve ( 12 ) months from the Effective Date, in alignment with the Collaboration Agreement . 4. No Right to Modify : Distributor shall not modify, alter, or reverse engineer the AOT Units without prior written consent of the Manufacturer. Improvements will be memorialized via an engineering services agreement between QS Energy and VIPS. 5. Improvements : Distributor will work closely with the manufacturer to improve AOT units and these improvements will be co - credited to both the manufacturer and distributor via a separate new or continuation in part patent. These improvements will be memorialized via an engineering services agreement between QS Energy and VIPS. 6. Supply Chain: Distributor will work closely with the manufacturer to improve, expand, and enhance all aspects of the AOT supply chain, including but not limited to AOT components. Improvements will be memorialized via an engineering services agreement between QS Energy and VIPS. 7. Systems & Technology: Distributor will co - develop all aspects of the AOT technology stack, system, communications, data and all other various IT requirements. Improvements will be memorialized via an engineering services agreement between QS Energy and VIPS. 2. TERM AND TERMINATION 1. Term : This Agreement shall commence on the Effective Date and remain in effect for ten (10) years , unless terminated earlier under Section 2.2. 2. Termination for Cause : ● Either party may terminate this Agreement upon thirty (30) days’ written notice if the other party materially breaches any provision and fails to cure within the notice period. ● Manufacturer may terminate immediately if Distributor engages in non - payment, fraud, misrepresentation, or non - compliance with U.S. SEC and FCPA regulations . Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

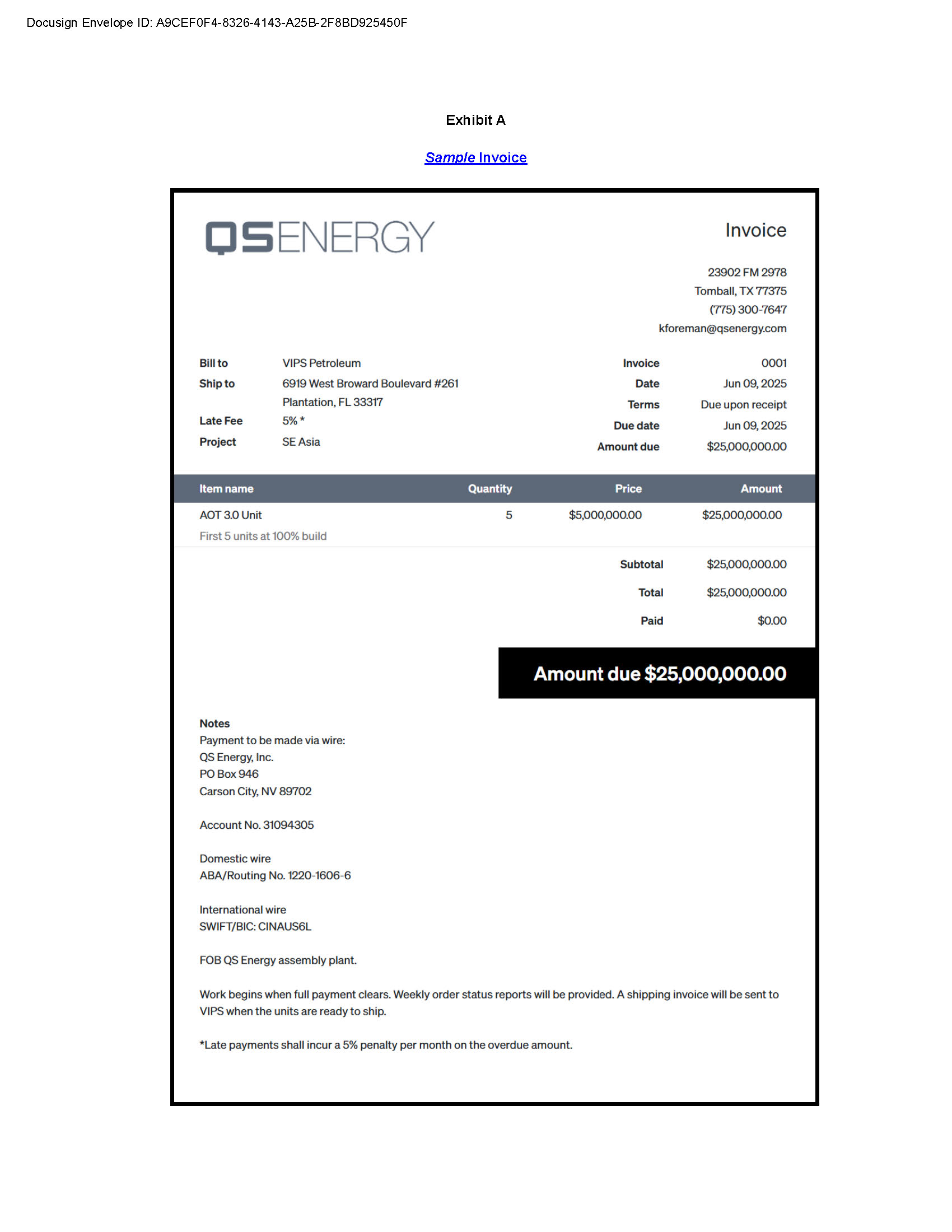

3. Effect of Termination : Upon termination, Distributor shall cease marketing and sales activities and return all confidential information, marketing materials, and unused inventory to the Manufacturer. 4. Additional Revenue : The ten ( 10 ) year term on this agreement has no impact on any and all incremental revenue which is governed by the details of the “additional revenue agreement/addendum” which is defined in Amendment 2 . 5. Auto Renewal : The ten (10) year term on this agreement auto renews for ten (10) years unless either party provides notice of contract termination one (1) year prior to the initial ten (10) contract end date. 3. REVENUE SHARING & PAYMENT TERMS & OTHER CONSIDERATIONS 1. Revenue Model Options: Distributor may choose between the following revenue models on a per - contract basis: Commission Model ● 10% Commission Model: Distributor may opt to receive a 10% commission on gross revenue from specific contracts in alignment with the Collaboration Agreement. OR MSRP + Rebate Model: ● Manufacturer shall invoice the Distributor at the full Manufacturer Suggested Retail Price (MSRP) of $5,000,000 USD per unit. Distributor shall remit full payment of $5,000,000 per unit. Upon confirmation of cleared funds, QS Energy will process a post - sale rebate 15% of the MSRP ($750,000 per unit) to Distributor within one (1) business day. The rebate shall be treated as a marketing rebate or contra - revenue transaction for financial reporting purposes, in compliance with GAAP. The gross revenue recognized per unit will remain $5,000,000. A portion of these rebates will be used for the warrant purchase outlined in Amendment 3. 2. Additional Revenue (Amendment 2) The parties shall share additional revenue generated from sales above and beyond unit sales, i.e., incremental barrels, etc. Each agreement and order with each region will have a custom arrangement between the Distributor and the Manufacturer for additional revenue. These terms will be negotiated and memorialized by executing an “Additional Revenue” addendum to this agreement which is listed as Amendment 2. 3. Order Process & Payment Terms : Exhibit B – Orders ● Order Placement. All purchase orders (“Orders”) shall be submitted by Distributor (VIPS) to Manufacturer (QS Energy) either: a. by written purchase order transmitted via electronic mail or other secure electronic message system, or b. by telephone, provided that telephonic orders must be confirmed in writing within forty - eight (48) hours. ● Confirmation & Invoicing. Upon receipt of an Order, the Manufacturer shall issue an invoice (“Invoice”) to the Distributor via electronic mail. The Invoice shall set forth the purchase price, shipping terms, and any other applicable charges. Distributor shall review and approve the Invoice prior to remitting payment. Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

● Commencement of Order Processing. The manufacturer shall commence processing of an Order only upon receipt of full cleared payment in accordance with Section [Payments] below. Exhibit A (Amendment 1) – Payments ● Payment Terms. Unless otherwise agreed in writing, the standard payment terms are Net Zero (i.e., full payment due upon Order submission, prior to processing or delivery). ● Requests for Deferred Terms. Distributors may request deferred payment terms (e.g., Net 30) on a per - order basis. Approval of such requests shall be at the sole discretion of Manufacturer and shall be subject to Distributor’s delivery of satisfactory proof of funds and other financial documentation reasonably requested by Manufacturer. ● Initial Purchase Order. This Agreement incorporates Purchase Order No. 1 (“PO#1”) for two (2) AOT units totaling Ten Million U.S. Dollars (USD $10,000,000). ● This Order is deemed approved, subject to completion of the standby letter of credit (“SBLC”) process described herein. ● Distributor represents that its partner bank has approved the outbound wire transfer, which remains subject to (i) know - your - customer (“KYC”) compliance, and (ii) final SBLC verification. ● Special Conditions for PO#1. Due to the developmental stage of the AOT units, the status of the wire transfer and SBLC verification may be adjusted as required. Notwithstanding such adjustments, PO#1 shall remain upon both Parties and recognized as “in process.” Amendment 1 – Approvals & Funding Conditions ● Final Authority. No Order shall be deemed fully authorized unless and until it has been approved and executed via DocuSign by John McCleod Jr., or his duly authorized designee. ● Funding Release. Release of Distributor’s funding shall be contingent on: a. DocuSign execution by John McCleod Jr., b. Confirmation by the Manufacturer that the criteria for the applicable SBLC have been satisfied. ● International Transactions. The Parties acknowledge and agree that Orders fulfilled in different jurisdictions may require separate payment and banking arrangements. Each country or territory shall be treated as a separate business unit of Distributor (e.g., VIPS Malaysia, Inc., or equivalent local entity). Distributors shall remain responsible for ensuring compliance with all local banking, currency control, and regulatory requirements. 3.4 Currency & Exchange Rates : ● All transactions shall be conducted in U.S. Dollars (USD) . ● The distributor assumes all currency exchange risks related to foreign transactions. 3.5 Additional Consideration (Amendment 3) ● VIPS/Stephen Bosco will be issued 25 Million shares of QSEP after QSEP receives a payment for an order of (2) units at $5 Million USD per unit. ● VIPS/Stephen Bosco will provide the proper information to QSEP to receive the shares. ● Details require additional agreements as outlined in the collaboration agreement below via section 4. “Consideration & Rights”. 4. COMPLIANCE & REGULATORY REQUIREMENTS Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

1. SEC Compliance : Manufacturer, as a publicly traded entity , shall ensure compliance with: ● Securities Act of 1933 and Securities Exchange Act of 1934 . ● GAAP/IFRS financial reporting . ● Full and fair disclosure of material business terms. 2. FCPA & Anti - Corruption : ● Distributors shall not offer or accept bribes or unlawful incentives . ● The distributor shall maintain accurate records of all transactions related to this Agreement. 3. Export Control : Manufacturer and Distributor shall comply with U.S. Export Administration Regulations (EAR) and Office of Foreign Assets Control (OFAC) sanctions . 5. PERFORMANCE & SUPPORT 1. Manufacturer’s Obligations : ● Provide Distributor with marketing materials, technical training, and installation support . ● Confirm AOT Units meet minimum performance standards . ● Travel to distributor and end user as needed. 2. Distributor’s Obligations : ● Actively market, sell, and lease AOT Units. ● Provide post - sale customer and installation support and performance monitoring (wholesale model only) ● Maintain proper sales documentation and reporting to the Manufacturer. ● Travel to customers as needed. 6. WARRANTIES & LIABILITY 1. Manufacturer Warranty : ● Manufacturer warrants that the AOT Units are free from material and workmanship defects for twelve (12) months from installation or ( 18) months from shipment whichever is shorter . ● Warranty claims must be reported within 30 days of defective discovery and submitted via email to QS Energy. ● To process warranty claims equipment must be sent to a QS Energy approved site for evaluation. ● QS Energy has (10) days to approve or deny the warranty claim. ● If equipment qualifies for a warranty, the manufacturer will elect to repair or replace the equipment at their sole option. 1. Limitation of Liability : ● Manufacturer’s liability is limited to direct damages , not exceeding total payments received under this Agreement . ● Neither party shall be liable for consequential, incidental, special, or punitive damages . 5. DISPUTE RESOLUTION & GOVERNING LAW 1. Arbitration : Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

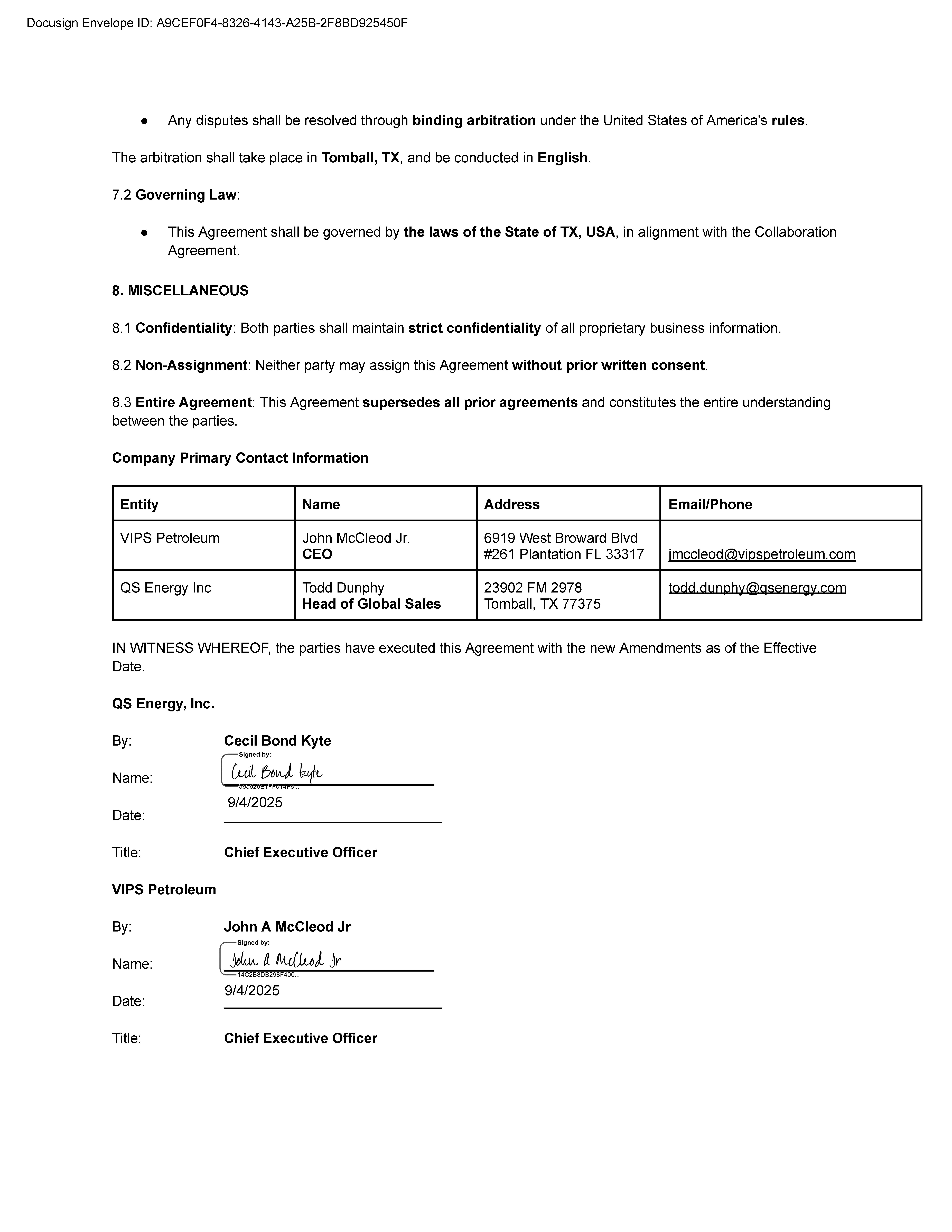

● Any disputes shall be resolved through binding arbitration under the United States of America's rules . The arbitration shall take place in Tomball, TX , and be conducted in English . 7.2 Governing Law : ● This Agreement shall be governed by the laws of the State of TX, USA , in alignment with the Collaboration Agreement. 8. MISCELLANEOUS 1. Confidentiality : Both parties shall maintain strict confidentiality of all proprietary business information. 2. Non - Assignment : Neither party may assign this Agreement without prior written consent . 3. Entire Agreement : This Agreement supersedes all prior agreements and constitutes the entire understanding between the parties. Company Primary Contact Information Email/Phone Address Name Entity jmccleod@vipspetroleum.com 6919 West Broward Blvd #261 Plantation FL 33317 John McCleod Jr. CEO VIPS Petroleum todd.dunphy@qsenergy.com 23902 FM 2978 Tomball, TX 77375 Todd Dunphy Head of Global Sales QS Energy Inc IN WITNESS WHEREOF, the parties have executed this Agreement with the new Amendments as of the Effective Date. QS Energy, Inc. By: Cecil Bond Kyte Name: 9/4/2025 Date: Title: Chief Executive Officer VIPS Petroleum By: John A McCleod Jr Name: ________________ Date: Title: Chief Executive Officer Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F 9/4/2025

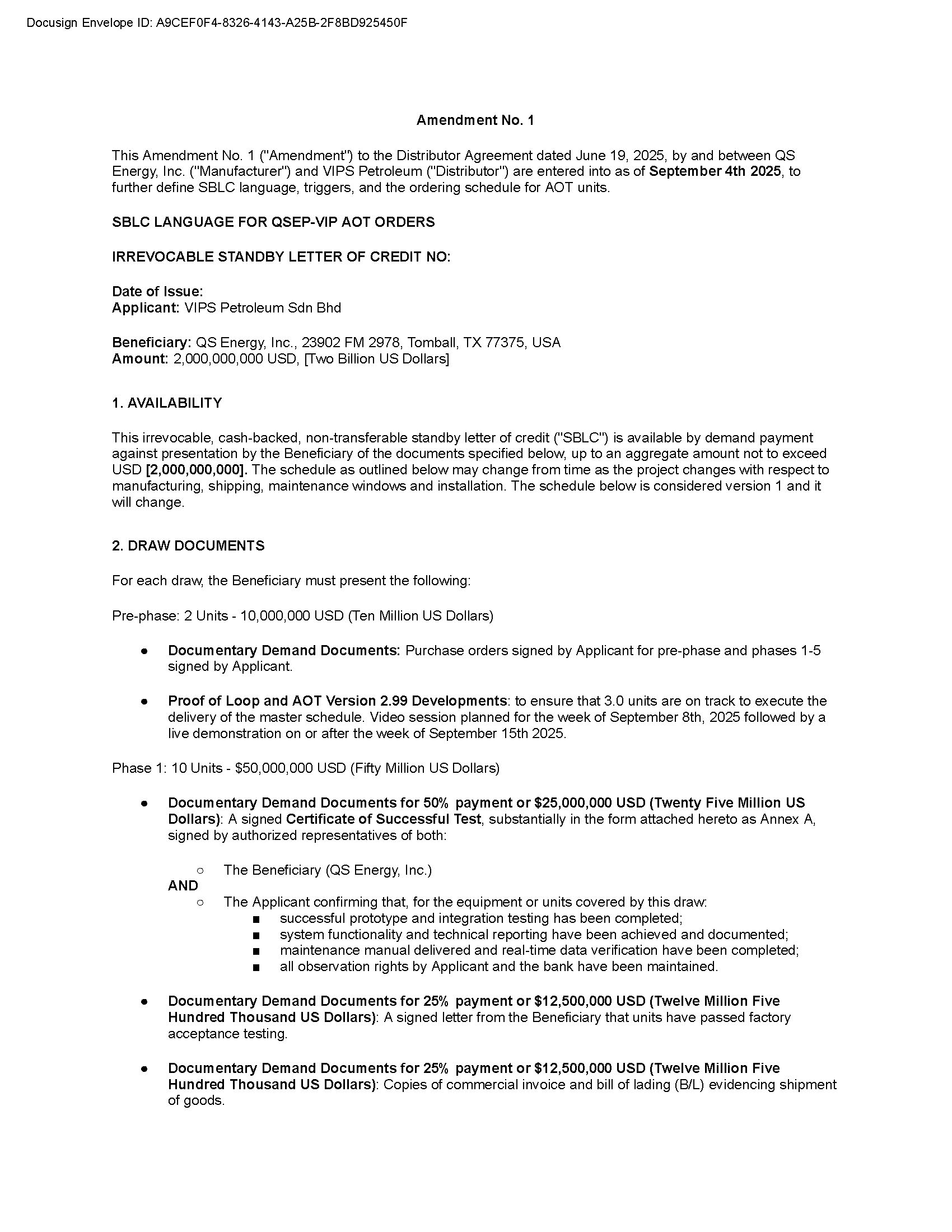

Amendment No. 1 This Amendment No. 1 ("Amendment") to the Distributor Agreement dated June 19, 2025, by and between QS Energy, Inc. ("Manufacturer") and VIPS Petroleum ("Distributor") are entered into as of September 4th 2025 , to further define SBLC language, triggers, and the ordering schedule for AOT units. SBLC LANGUAGE FOR QSEP - VIP AOT ORDERS IRREVOCABLE STANDBY LETTER OF CREDIT NO: Date of Issue: Applicant: VIPS Petroleum Sdn Bhd Beneficiary: QS Energy, Inc., 23902 FM 2978, Tomball, TX 77375, USA Amount: 2,000,000,000 USD, [Two Billion US Dollars] 1. AVAILABILITY This irrevocable, cash - backed, non - transferable standby letter of credit ("SBLC") is available by demand payment against presentation by the Beneficiary of the documents specified below, up to an aggregate amount not to exceed USD [2,000,000,000]. The schedule as outlined below may change from time as the project changes with respect to manufacturing, shipping, maintenance windows and installation. The schedule below is considered version 1 and it will change. 2. DRAW DOCUMENTS For each draw, the Beneficiary must present the following: Pre - phase: 2 Units - 10,000,000 USD (Ten Million US Dollars) ● Documentary Demand Documents : Purchase orders signed by Applicant for pre - phase and phases 1 - 5 signed by Applicant . ● Proof of Loop and AOT Version 2 . 99 Developments : to ensure that 3 . 0 units are on track to execute the delivery of the master schedule . Video session planned for the week of September 8 th, 2025 followed by a live demonstration on or after the week of September 15 th 2025 . Phase 1: 10 Units - $50,000,000 USD (Fifty Million US Dollars) ● Documentary Demand Documents for 50% payment or $25,000,000 USD (Twenty Five Million US Dollars) : A signed Certificate of Successful Test , substantially in the form attached hereto as Annex A, signed by authorized representatives of both: ○ The Beneficiary (QS Energy, Inc.) AND ○ The Applicant confirming that, for the equipment or units covered by this draw: ■ successful prototype and integration testing has been completed; ■ system functionality and technical reporting have been achieved and documented; ■ maintenance manual delivered and real - time data verification have been completed; ■ all observation rights by Applicant and the bank have been maintained. ● Documentary Demand Documents for 25% payment or $12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars) : A signed letter from the Beneficiary that units have passed factory acceptance testing. ● Documentary Demand Documents for 25% payment or $12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars) : Copies of commercial invoice and bill of lading (B/L) evidencing shipment of goods. Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

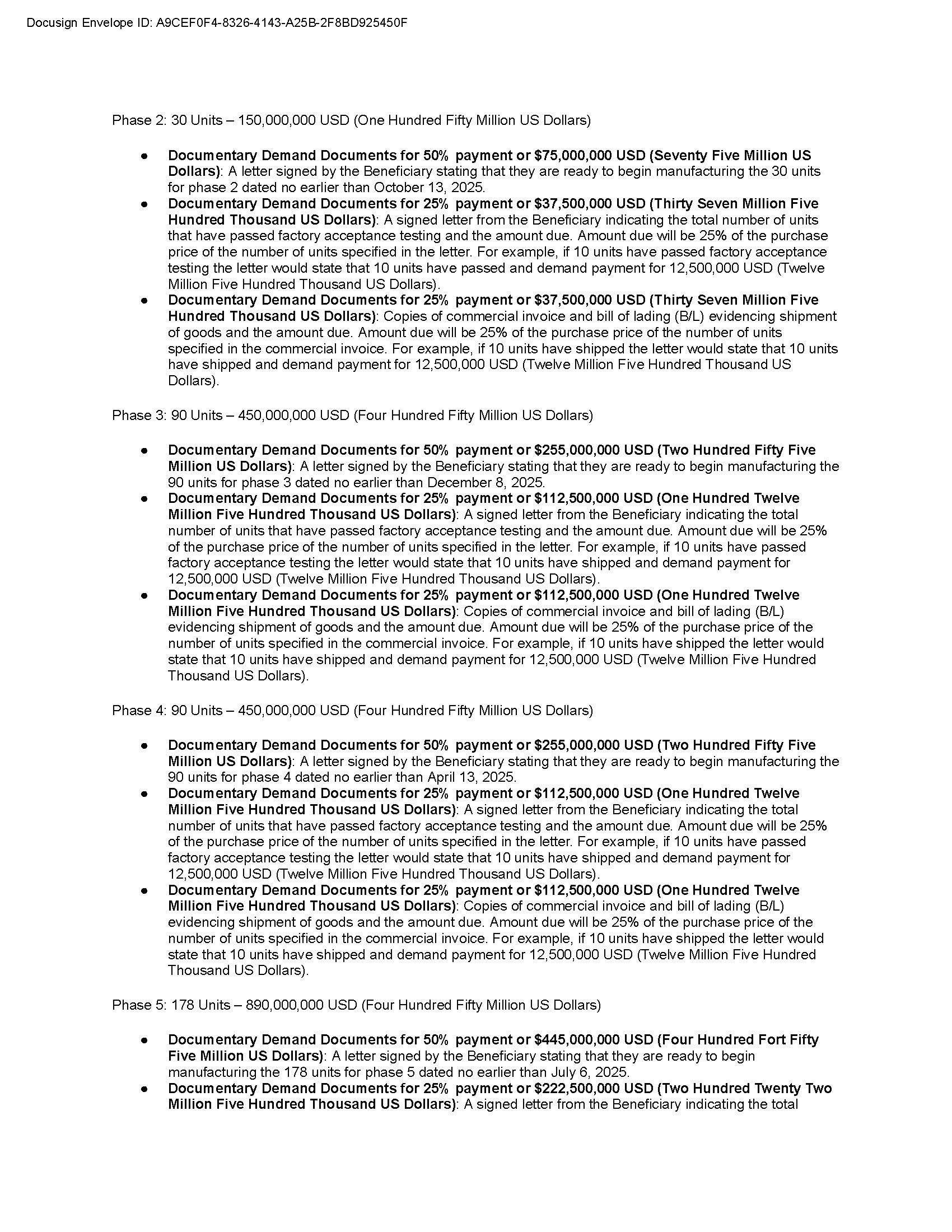

Phase 2: 30 Units – 150,000,000 USD (One Hundred Fifty Million US Dollars) ● Documentary Demand Documents for 50% payment or $75,000,000 USD (Seventy Five Million US Dollars) : A letter signed by the Beneficiary stating that they are ready to begin manufacturing the 30 units for phase 2 dated no earlier than October 13, 2025. ● Documentary Demand Documents for 25% payment or $37,500,000 USD (Thirty Seven Million Five Hundred Thousand US Dollars) : A signed letter from the Beneficiary indicating the total number of units that have passed factory acceptance testing and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the letter. For example, if 10 units have passed factory acceptance testing the letter would state that 10 units have passed and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). ● Documentary Demand Documents for 25% payment or $37,500,000 USD (Thirty Seven Million Five Hundred Thousand US Dollars) : Copies of commercial invoice and bill of lading (B/L) evidencing shipment of goods and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the commercial invoice. For example, if 10 units have shipped the letter would state that 10 units have shipped and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). Phase 3: 90 Units – 450,000,000 USD (Four Hundred Fifty Million US Dollars) ● Documentary Demand Documents for 50% payment or $255,000,000 USD (Two Hundred Fifty Five Million US Dollars) : A letter signed by the Beneficiary stating that they are ready to begin manufacturing the 90 units for phase 3 dated no earlier than December 8, 2025. ● Documentary Demand Documents for 25% payment or $112,500,000 USD (One Hundred Twelve Million Five Hundred Thousand US Dollars) : A signed letter from the Beneficiary indicating the total number of units that have passed factory acceptance testing and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the letter. For example, if 10 units have passed factory acceptance testing the letter would state that 10 units have shipped and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). ● Documentary Demand Documents for 25% payment or $112,500,000 USD (One Hundred Twelve Million Five Hundred Thousand US Dollars) : Copies of commercial invoice and bill of lading (B/L) evidencing shipment of goods and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the commercial invoice. For example, if 10 units have shipped the letter would state that 10 units have shipped and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). Phase 4: 90 Units – 450,000,000 USD (Four Hundred Fifty Million US Dollars) ● Documentary Demand Documents for 50% payment or $255,000,000 USD (Two Hundred Fifty Five Million US Dollars) : A letter signed by the Beneficiary stating that they are ready to begin manufacturing the 90 units for phase 4 dated no earlier than April 13, 2025. ● Documentary Demand Documents for 25% payment or $112,500,000 USD (One Hundred Twelve Million Five Hundred Thousand US Dollars) : A signed letter from the Beneficiary indicating the total number of units that have passed factory acceptance testing and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the letter. For example, if 10 units have passed factory acceptance testing the letter would state that 10 units have shipped and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). ● Documentary Demand Documents for 25% payment or $112,500,000 USD (One Hundred Twelve Million Five Hundred Thousand US Dollars) : Copies of commercial invoice and bill of lading (B/L) evidencing shipment of goods and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the commercial invoice. For example, if 10 units have shipped the letter would state that 10 units have shipped and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). Phase 5: 178 Units – 890,000,000 USD (Four Hundred Fifty Million US Dollars) ● Documentary Demand Documents for 50% payment or $445,000,000 USD (Four Hundred Fort Fifty Five Million US Dollars) : A letter signed by the Beneficiary stating that they are ready to begin manufacturing the 178 units for phase 5 dated no earlier than July 6, 2025. ● Documentary Demand Documents for 25% payment or $222,500,000 USD (Two Hundred Twenty Two Million Five Hundred Thousand US Dollars) : A signed letter from the Beneficiary indicating the total Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

number of units that have passed factory acceptance testing and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the letter. For example, if 10 units have passed factory acceptance testing the letter would state that 10 units have shipped and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). ● Documentary Demand Documents for 25% payment or $222,500,000 USD (Two Hundred Twenty Two Million Five Hundred Thousand US Dollars) : Copies of commercial invoice and bill of lading (B/L) evidencing shipment of goods and the amount due. Amount due will be 25% of the purchase price of the number of units specified in the commercial invoice. For example, if 10 units have shipped the letter would state that 10 units have shipped and demand payment for 12,500,000 USD (Twelve Million Five Hundred Thousand US Dollars). 3. SPECIAL TERMS ● Partial drawings under this SBLC are expressly permitted , provided that each partial draw complies with the milestone and documentation process described above. During Phases 1 - 5 it is anticipated that demand documents will be presented based on factory acceptance testing completion in groups of 10 units. Demands for shipping will be based on the number of units available when a ship is ready to load and likely to be multiples of 10 units. ● Observation Rights: The Applicant and its bank retain the right to observe and verify each milestone event in person or virtually, as described in the underlying contract and associated POs. ● Documents may be presented in original or legible copy; originals available upon request. ● Governing Rules: This SBLC is subject to ISP98 ● Independent Undertaking: Payment under this SBLC is subject solely to presentation of the documents required above and shall not be subject to any other dispute or set - off. 4. ANNEX A — FORM OF JOINT CERTIFICATE JOINT CERTIFICATE OF SUCCESSFUL TEST QSEP - VIP AOT Purchase Order We, the undersigned, certify that for the goods/shipment referenced above: ● All contractually defined technical and commercial milestones, including successful prototype delivery and loop integration, and data collection and cloud based data storage are functioning, have been demonstrated in accordance with the contract and referenced purchase order. ● All such milestones were observed as contractually required by the Purchaser and/or their authorized representatives either in person or virtually at their option. Sincerely, John McCleod Jr. Chief Executive Officer VIPS Petroleum jmccleod@vipspetroleum.com (571) 575 - 6050 https://vipspetroleum.com/ General Provisions Except as expressly modified by this Amendment, all terms and conditions of the original Distributor Agreement and prior amendments shall remain in full force and effect. Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

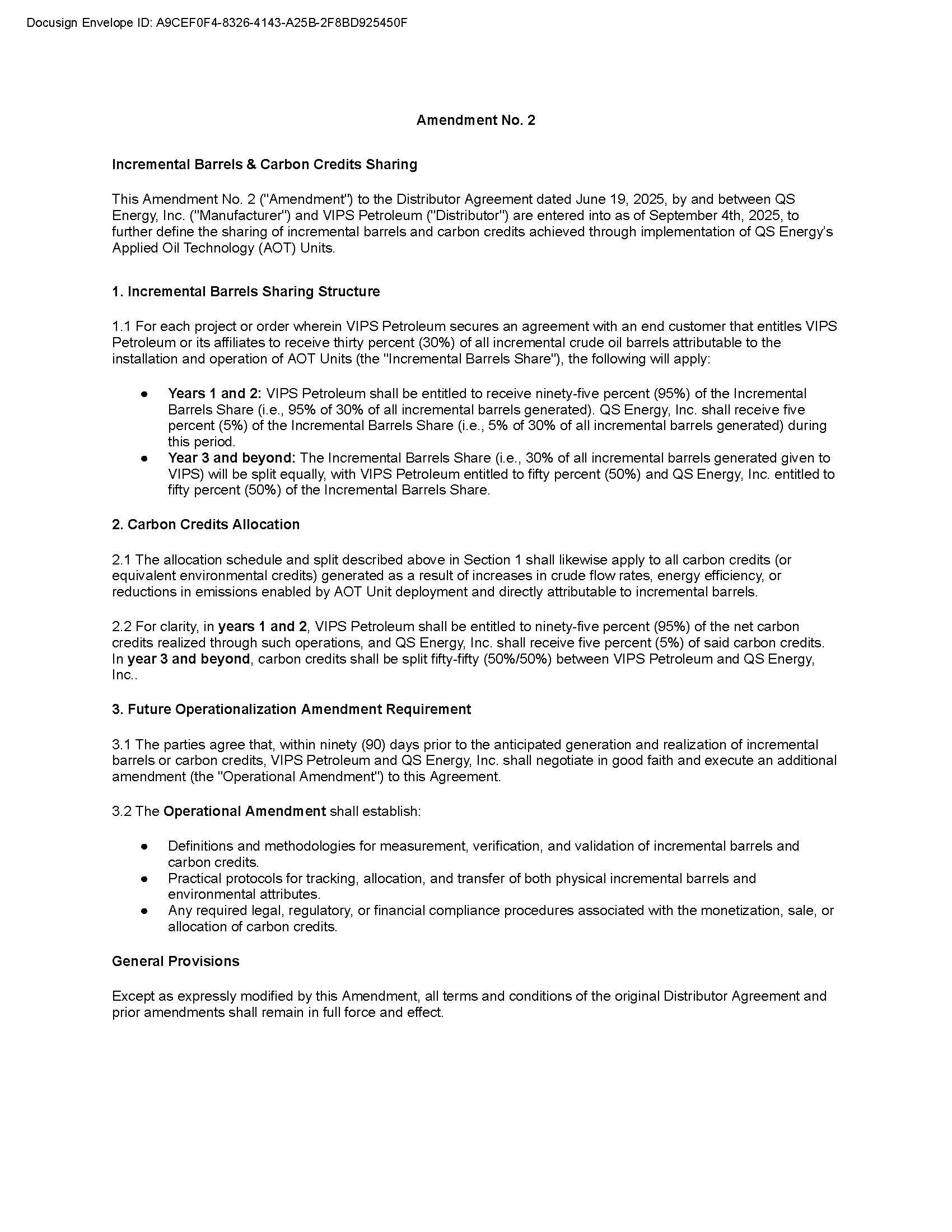

Amendment No. 2 Incremental Barrels & Carbon Credits Sharing This Amendment No. 2 ("Amendment") to the Distributor Agreement dated June 19, 2025, by and between QS Energy, Inc. ("Manufacturer") and VIPS Petroleum ("Distributor") are entered into as of September 4th, 2025, to further define the sharing of incremental barrels and carbon credits achieved through implementation of QS Energy’s Applied Oil Technology (AOT) Units. 1. Incremental Barrels Sharing Structure 1. For each project or order wherein VIPS Petroleum secures an agreement with an end customer that entitles VIPS Petroleum or its affiliates to receive thirty percent (30%) of all incremental crude oil barrels attributable to the installation and operation of AOT Units (the "Incremental Barrels Share"), the following will apply: ● Years 1 and 2: VIPS Petroleum shall be entitled to receive ninety - five percent (95%) of the Incremental Barrels Share (i.e., 95% of 30% of all incremental barrels generated). QS Energy, Inc. shall receive five percent (5%) of the Incremental Barrels Share (i.e., 5% of 30% of all incremental barrels generated) during this period. ● Year 3 and beyond: The Incremental Barrels Share (i.e., 30% of all incremental barrels generated given to VIPS) will be split equally, with VIPS Petroleum entitled to fifty percent (50%) and QS Energy, Inc. entitled to fifty percent (50%) of the Incremental Barrels Share. 2. Carbon Credits Allocation 1. The allocation schedule and split described above in Section 1 shall likewise apply to all carbon credits (or equivalent environmental credits) generated as a result of increases in crude flow rates, energy efficiency, or reductions in emissions enabled by AOT Unit deployment and directly attributable to incremental barrels. 2. For clarity, in years 1 and 2 , VIPS Petroleum shall be entitled to ninety - five percent (95%) of the net carbon credits realized through such operations, and QS Energy, Inc. shall receive five percent (5%) of said carbon credits. In year 3 and beyond , carbon credits shall be split fifty - fifty (50%/50%) between VIPS Petroleum and QS Energy, Inc.. 3. Future Operationalization Amendment Requirement 1. The parties agree that, within ninety (90) days prior to the anticipated generation and realization of incremental barrels or carbon credits, VIPS Petroleum and QS Energy, Inc. shall negotiate in good faith and execute an additional amendment (the "Operational Amendment") to this Agreement. 2. The Operational Amendment shall establish: ● Definitions and methodologies for measurement, verification, and validation of incremental barrels and carbon credits. ● Practical protocols for tracking, allocation, and transfer of both physical incremental barrels and environmental attributes. ● Any required legal, regulatory, or financial compliance procedures associated with the monetization, sale, or allocation of carbon credits. General Provisions Except as expressly modified by this Amendment, all terms and conditions of the original Distributor Agreement and prior amendments shall remain in full force and effect. Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

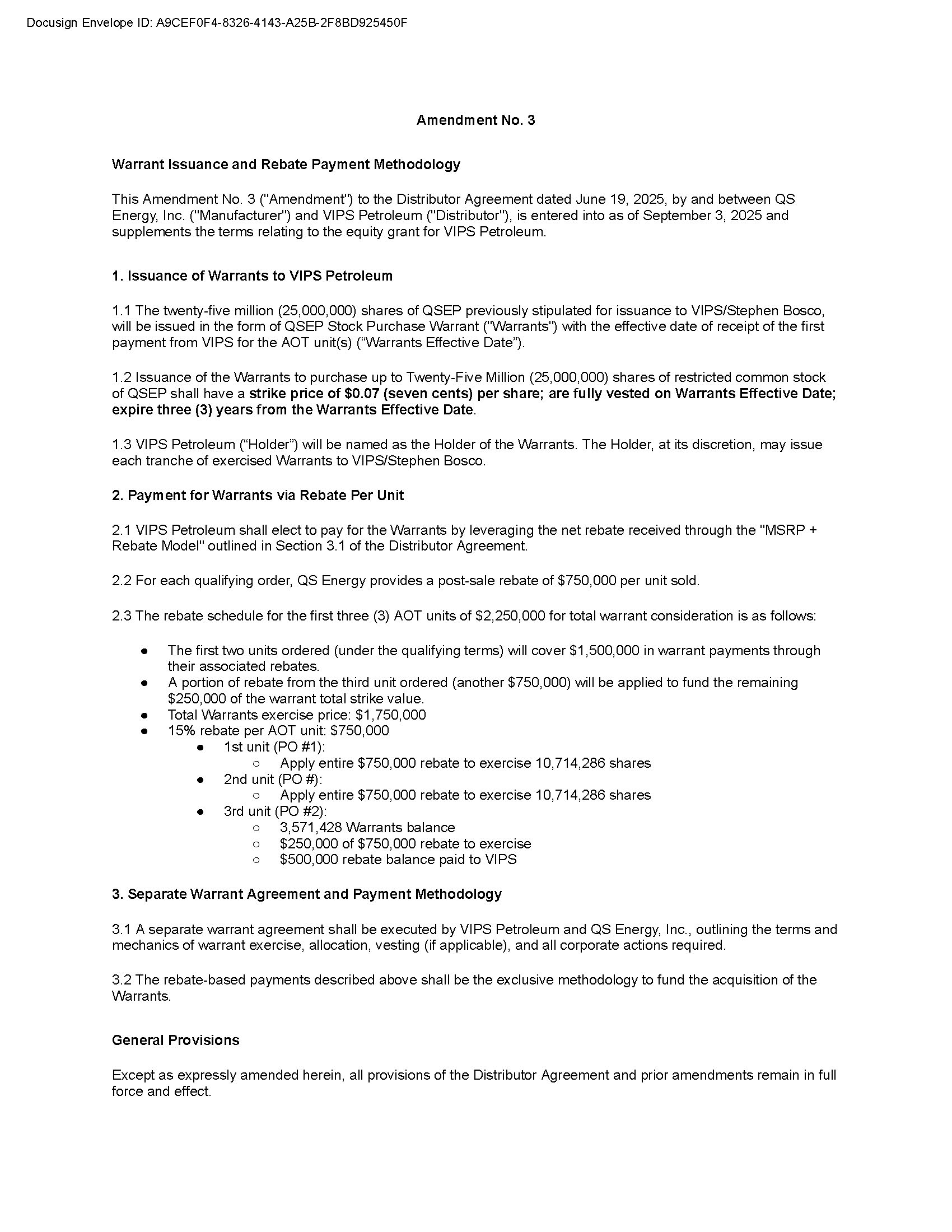

Amendment No. 3 Warrant Issuance and Rebate Payment Methodology This Amendment No. 3 ("Amendment") to the Distributor Agreement dated June 19, 2025, by and between QS Energy, Inc. ("Manufacturer") and VIPS Petroleum ("Distributor"), is entered into as of September 3, 2025 and supplements the terms relating to the equity grant for VIPS Petroleum. 1. Issuance of Warrants to VIPS Petroleum 1. The twenty - five million ( 25 , 000 , 000 ) shares of QSEP previously stipulated for issuance to VIPS/Stephen Bosco, will be issued in the form of QSEP Stock Purchase Warrant ("Warrants") with the effective date of receipt of the first payment from VIPS for the AOT unit(s) (“Warrants Effective Date”) . 2. Issuance of the Warrants to purchase up to Twenty - Five Million (25,000,000) shares of restricted common stock of QSEP shall have a strike price of $0.07 (seven cents) per share; are fully vested on Warrants Effective Date; expire three (3) years from the Warrants Effective Date . 3. VIPS Petroleum (“Holder”) will be named as the Holder of the Warrants. The Holder, at its discretion, may issue each tranche of exercised Warrants to VIPS/Stephen Bosco. 2. Payment for Warrants via Rebate Per Unit 1. VIPS Petroleum shall elect to pay for the Warrants by leveraging the net rebate received through the "MSRP + Rebate Model" outlined in Section 3.1 of the Distributor Agreement. 2. For each qualifying order, QS Energy provides a post - sale rebate of $750,000 per unit sold. 3. The rebate schedule for the first three (3) AOT units of $2,250,000 for total warrant consideration is as follows: ● The first two units ordered (under the qualifying terms) will cover $1,500,000 in warrant payments through their associated rebates. ● A portion of rebate from the third unit ordered (another $750,000) will be applied to fund the remaining $250,000 of the warrant total strike value. ● Total Warrants exercise price: $1,750,000 ● 15% rebate per AOT unit: $750,000 ● 1st unit (PO #1): ○ Apply entire $750,000 rebate to exercise 10,714,286 shares ● 2nd unit (PO #): ○ Apply entire $750,000 rebate to exercise 10,714,286 shares ● 3rd unit (PO #2): ○ 3,571,428 Warrants balance ○ $250,000 of $750,000 rebate to exercise ○ $500,000 rebate balance paid to VIPS 2. Separate Warrant Agreement and Payment Methodology 1. A separate warrant agreement shall be executed by VIPS Petroleum and QS Energy, Inc., outlining the terms and mechanics of warrant exercise, allocation, vesting (if applicable), and all corporate actions required. 2. The rebate - based payments described above shall be the exclusive methodology to fund the acquisition of the Warrants. General Provisions Except as expressly amended herein, all provisions of the Distributor Agreement and prior amendments remain in full force and effect. Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

Exhibit A Sample Invoice Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

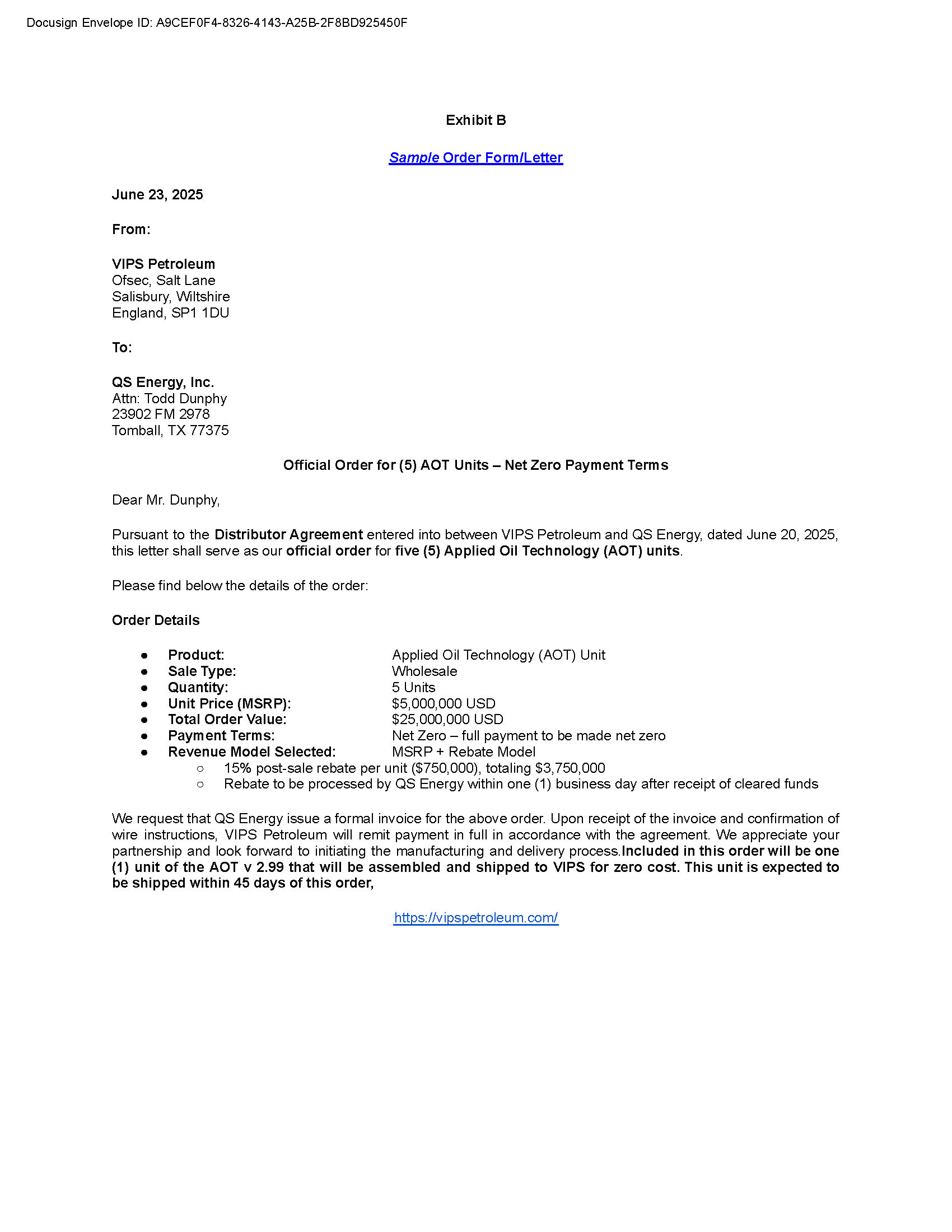

Exhibit B Sample Order Form/Letter June 23, 2025 From: VIPS Petroleum Ofsec, Salt Lane Salisbury, Wiltshire England, SP1 1DU To: QS Energy, Inc. Attn: Todd Dunphy 23902 FM 2978 Tomball, TX 77375 Official Order for (5) AOT Units – Net Zero Payment Terms Dear Mr. Dunphy, Pursuant to the Distributor Agreement entered into between VIPS Petroleum and QS Energy, dated June 20, 2025, this letter shall serve as our official order for five (5) Applied Oil Technology (AOT) units . Please find below the details of the order: Order Details ● Product: ● Sale Type: ● Quantity: ● Unit Price (MSRP): ● Total Order Value: ● Payment Terms: ● Revenue Model Selected: Applied Oil Technology (AOT) Unit Wholesale 5 Units $5,000,000 USD $25,000,000 USD Net Zero – full payment to be made net zero MSRP + Rebate Model ○ 15% post - sale rebate per unit ($750,000), totaling $3,750,000 ○ Rebate to be processed by QS Energy within one (1) business day after receipt of cleared funds We request that QS Energy issue a formal invoice for the above order . Upon receipt of the invoice and confirmation of wire instructions, VIPS Petroleum will remit payment in full in accordance with the agreement . We appreciate your partnership and look forward to initiating the manufacturing and delivery process . Included in this order will be one ( 1 ) unit of the AOT v 2 . 99 that will be assembled and shipped to VIPS for zero cost . This unit is expected to be shipped within 45 days of this order, https://vipspetroleum.com/ Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

PURCHASE ORDER #1 — Pre - Phase Paid Test Units Purchase Order Number: PO - 001 Date: September 3 2025 Purchaser: VIPS Petroleum Vendor: QS Energy, Inc. Reference Agreement: India/Malaysia – QS Energy AOT Purchase Agreement (Aug 7, 2025, v1) and the Signed June 2025 Distribution Agreement Phase : Pre - Phase — Paid Pilot/Test Units Description & Quantities: ● 2 AOT Units (Version 3.0) ● Unit Price: $5,000,000 USD ● Total Value: $10,000,000 USD Payment Terms: ● Payment by wire transfer to QS Energy, Inc. ● Due within three (3) business days of contract signing, per Section 3.2. Delivery Timeline: ● Units delivered as per schedule Milestone & Certification: ● Units to be tested and certified as per contract Section 3.3 (Prototype & Integration Testing; Certification). Special Instructions: ● No SBLC required for this PO. ● Subject to mutual observation and certification as defined in Sections 3.3 and 3.4. Sincerely, John McCleod Jr. Chief Executive Officer VIPS Petroleum jmccleod@vipspetroleum.co www.vipspetroleum.co Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

PURCHASE ORDER #2 — Phase 1 Bulk Units Purchase Order Number: PO - 002 Date: October 8 2025 Purchaser: VIPS Petroleum Vendor: QS Energy, Inc. Reference Agreement: India/Malaysia – QS Energy AOT Purchase Agreement (Aug 7, 2025, v1) and the Signed June 2025 Distribution Agreement Phase: Phase 1 – Initial Production Units Description & Quantities: ● 10 AOT Units ● Unit Price: $5,000,000 USD ● Total Value: $50,000,000 USD Payment Terms: ● Payment shall be secured and executed via irrevocable, unconditional, and non - transferable Standby Letter of Credit (SBLC), in accordance with Sections 3.1, 3.3 of the contract. ● SBLC issued by a top - tier bank, denominated in USD, cash - backed, SWIFT MT760, compliant with ICC UCP600/ISP98. ● Payment released per milestone triggers: ○ Prototype & integration testing (Section 3.3.1.1), ○ System functionality & reporting (Section 3.3.1.2), ○ Maintenance & data verification (Section 3.3.1.3), ○ Certificate of Successful Test issued (Section 3.3.1.4). Delivery Timeline: ● Units delivered as per schedule Additional Instructions: ● Documentation of successful test to accompany draw request per Section 3.3.2. SBLC Conditional Language “Payment for the goods described herein shall be made solely via a cash - backed, irrevocable, non - transferable Standby Letter of Credit (SBLC), issued in favor of QS Energy, Inc . and governed by ICC UCP 600 /ISP 98 and all contractually defined milestones . Release of funds shall be contingent on QS Energy’s achievement of the following triggers : successful prototype and integration testing, system functionality and technical reporting (including viscosity reduction), completion of maintenance and real - time data verification, and issuance of a Certificate of Successful Test jointly signed by authorized representatives of both Manufacturer and Purchaser . All observation rights as detailed in the contract (Section 3 . 3 ) shall apply . ” Sincerely, John McCleod Jr. Chief Executive Officer VIPS Petroleum jmccleod@vipspetroleum.co www.vipspetroleum.co Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

PURCHASE ORDER #3 — Phase 2 Units Purchase Order Number: PO - 003 Date: November 7 2025 Purchaser: VIPS Petroleum Vendor: QS Energy, Inc. Reference Agreement: India/Malaysia – QS Energy AOT Purchase Agreement (Aug 7, 2025, v1) and the Signed June 2025 Distribution Agreement Phase: Phase 2 Description & Quantities: ● 30 AOT Units ● Unit Price: $5,000,000 USD ● Total Value: $150,000,000 USD Payment & SBLC Terms: ● Payment secured via SBLC per Sections 3.1, 3.3. ● Same SBLC language as PO - 002 applies: ○ “SBLC proceeds shall be released only upon achievement and mutual certification of technical milestones, via signed Certificate of Successful Test, with observation rights provided to bank and purchaser representatives.” Delivery Timeline: ● Units delivered as per schedule Additional Instructions: ● Required documentation and certifications per contract Section 3.3.2. General SBLC Conditional Language for POs : “Payment for the goods described herein shall be made solely via a cash - backed, irrevocable, non - transferable Standby Letter of Credit (SBLC), issued in favor of QS Energy, Inc . and governed by ICC UCP 600 /ISP 98 and all contractually defined milestones . Release of funds shall be contingent on QS Energy’s achievement of the following triggers : successful prototype and integration testing, system functionality and technical reporting (including viscosity reduction), completion of maintenance and real - time data verification, and issuance of a Certificate of Successful Test jointly signed by authorized representatives of both Manufacturer and Purchaser . All observation rights as detailed in the contract (Section 3 . 3 ) shall apply . ” Sincerely, John McCleod Jr. Chief Executive Officer VIPS Petroleum jmccleod@vipspetroleum.co www.vipspetroleum.co Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

PURCHASE ORDER #4 — Phase 3 Units Purchase Order Number: PO - 004 Date: February 5 2026 Purchaser: VIPS Petroleum Vendor: QS Energy, Inc. Reference Agreement: India/Malaysia – QS Energy AOT Purchase Agreement (Aug 7, 2025, v1) and the Signed June 2025 Distribution Agreement Phase: Phase 3 Description & Quantities: ● 90 AOT Units ● Unit Price: $5,000,000 USD ● Total Value: $450,000,000 USD Payment & SBLC Terms: ● Payment secured via SBLC per contract Sections 3.1, 3.3. ● Identical SBLC conditional language as above applies. Delivery Timeline: ● Units delivered as per schedule Additional Instructions: ● Certificate of Successful Test required for all milestone draws. General SBLC Conditional Language for POs : “Payment for the goods described herein shall be made solely via a cash - backed, irrevocable, non - transferable Standby Letter of Credit (SBLC), issued in favor of QS Energy, Inc . and governed by ICC UCP 600 /ISP 98 and all contractually defined milestones . Release of funds shall be contingent on QS Energy’s achievement of the following triggers : successful prototype and integration testing, system functionality and technical reporting (including viscosity reduction), completion of maintenance and real - time data verification, and issuance of a Certificate of Successful Test jointly signed by authorized representatives of both Manufacturer and Purchaser . All observation rights as detailed in the contract (Section 3 . 3 ) shall apply . ” Sincerely, John McCleod Jr. Chief Executive Officer VIPS Petroleum jmccleod@vipspetroleum.co www.vipspetroleum.co Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

PURCHASE ORDER #5 — Phase 4 Units Purchase Order Number: PO - 005 Date: July 21 2026 Purchaser: VIPS Petroleum Vendor: QS Energy, Inc. Reference Agreement: Malaysia – QS Energy AOT Purchase Agreement (Aug 7, 2025, v1) Phase: Phase 4 Description & Quantities: ● 90 AOT Units ● Unit Price: $5,000,000 USD ● Total Value: $450,000,000 USD Payment & SBLC Terms: ● Payment via SBLC, as per Sections 3.1, 3.3, with standard trigger and certification language. Delivery Timeline: ● Units delivered as per schedule Additional Instructions: General SBLC Conditional Language for POs : “Payment for the goods described herein shall be made solely via a cash - backed, irrevocable, non - transferable Standby Letter of Credit (SBLC), issued in favor of QS Energy, Inc . and governed by ICC UCP 600 /ISP 98 and all contractually defined milestones . Release of funds shall be contingent on QS Energy’s achievement of the following triggers : successful prototype and integration testing, system functionality and technical reporting (including viscosity reduction), completion of maintenance and real - time data verification, and issuance of a Certificate of Successful Test jointly signed by authorized representatives of both Manufacturer and Purchaser . All observation rights as detailed in the contract (Section 3 . 3 ) shall apply . ” Sincerely, John McCleod Jr. Chief Executive Officer VIPS Petroleum jmccleod@vipspetroleum.co ww.vipspetroleum.co Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F

PURCHASE ORDER #6 — Phase 5 Units Purchase Order Number: PO - 006 Date: December 2 2026 Purchaser: VIPS Petroleum Vendor: QS Energy, Inc. Reference Agreement: Malaysia – QS Energy AOT Purchase Agreement (Aug 7, 2025, v1) Phase: Phase 5 (Final Batch) Description & Quantities: ● 178 AOT Units (final balance to reach 400) ● Unit Price: $5,000,000 USD ● Total Value: $890,000,000 USD Payment & SBLC Terms: ● Payment via SBLC, per Sections 3.1, 3.3. ● All SBLC triggers, certification, and observation rights as above. Delivery Timeline: ● Units delivered as per schedule Additional Instructions: ● Completion certificate and all contract documentation required per draw. General SBLC Conditional Language for POs : “Payment for the goods described herein shall be made solely via a cash - backed, irrevocable, non - transferable Standby Letter of Credit (SBLC), issued in favor of QS Energy, Inc . and governed by ICC UCP 600 /ISP 98 and all contractually defined milestones . Release of funds shall be contingent on QS Energy’s achievement of the following triggers : successful prototype and integration testing, system functionality and technical reporting (including viscosity reduction), completion of maintenance and real - time data verification, and issuance of a Certificate of Successful Test jointly signed by authorized representatives of both Manufacturer and Purchaser . All observation rights as detailed in the contract (Section 3 . 3 ) shall apply . Sincerely, John McCleod Jr. Chief Executive Officer VIPS Petroleum jmccleod@vipspetroleum.co www.vipspetroleum.co Docusign Envelope ID: A9CEF0F4 - 8326 - 4143 - A25B - 2F8BD925450F